What is the difference between a W-9 and a 1099?

- Posted on Dec 24, 2014

January is always a busy month for bookkeepers. For my company, we process thousands of 1099′s across all our clients every year.

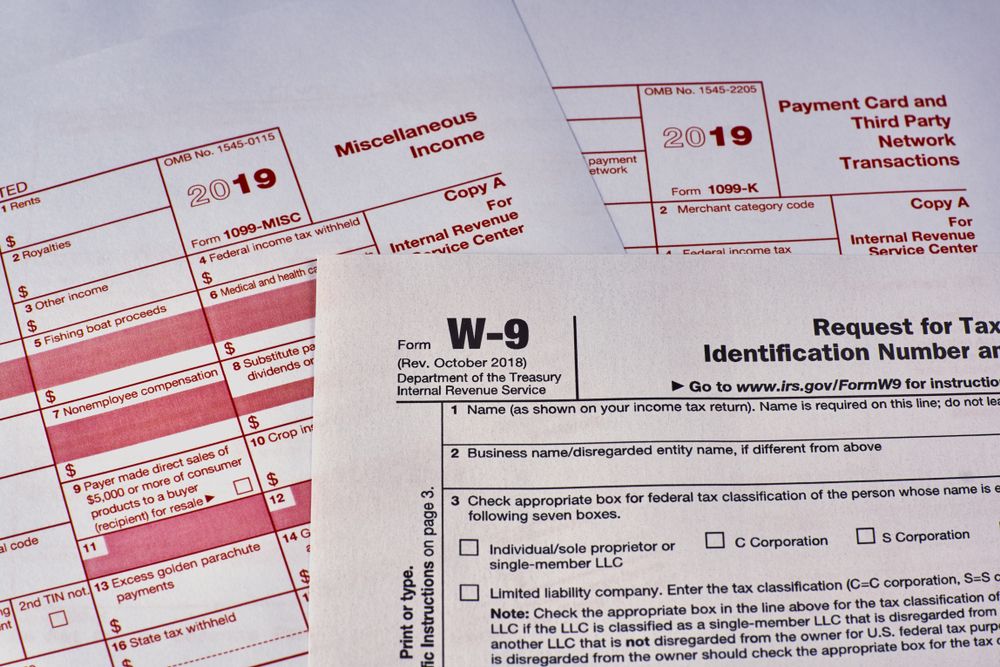

During our quest for gathering the information in order to file 1099′s, we ask vendors to fill out a W-9 form. Typically this should be done upon hiring of the vendor this way the books are in order when January hits. The differences between a W-9 and a 1099 are:A IRS W-9 form is a request for taxpayer identification number. Just like when you are hired on as employee and you fill out a W-4 form, a W-9 is for non-employees to give their information. Its also used to identify what type of entity the company is, i.e. sole-proprietor, partnership or a corporation which in turn let’s your bookkeeper know whether or not a 1099 is needed to file.

A IRS 1099-MISC is a form reporting one’s non-employment income from a given source for a year. This is in the form of rents, royalties, other income, fishing boat proceeds and non-employee compensation over $600.