Blog Series 4 of 5: Common QuickBooks Terms – What is Cash and Accrual

- Posted on Oct 25, 2018

What is Cash and Accrual?

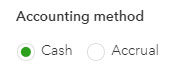

In our blog series 4 of 5, common Quickbooks terms – What is cash and accrual? Most business owners should know what these terms mean, but if you don’t work with them regularly, you may not remember the differences between them. Cash and accrual refers to how you report your income and expenses to the IRS.

- Cash – Your income is recognized when it is received by your customers and your expenses are recognized when they are paid to your vendors. In other words, cash means just that, you report your income and expenses on a cash basis, when they are paid.

- Accrual – Your income is recognized when it is earned or billed and your expenses are recognized when they are incurred. This means that you report your income and expenses when they are billed not when paid.

When you get a federal tax ID number from the IRS, you elect which reporting method you will follow. Once elected, you must file all tax returns under this filing status, consistently, as long as you are in business.

For internally reporting purposes, you can flip the report settings in QuickBooks to view what cash came in and out the door (cash basis) and what you billed to your customers and was billed by your vendors (accrual basis).

For internally reporting purposes, you can flip the report settings in QuickBooks to view what cash came in and out the door (cash basis) and what you billed to your customers and was billed by your vendors (accrual basis).

If you have any questions about this or a situation that you need advice on, please reach out or comment. Tomorrow and the final post in this series will be covering retained earnings and opening balance equity accounts.