Blog

Bookkeeping for Due to/from Accounts

- Posted on Sep 22, 2025

We have many clients that use due to/from accounts. The purpose is to track money that is owed to/from other entities. In the case of one of our clients, they have multiple business locations and books for each, and some expenses are paid from one business that belongs to the other business. The key to ... Read More

Tying out Payroll at End of Year

- Posted on Jan 30, 2025

If you are a bookkeeper closing out the books each year, you should be reconciling the books to payroll reports. At VBS, we do this monthly, quarterly as well as at the end of the year. As an additional step at year-end, we also tie out to the W3 transmittal. Every payroll company’s reports differ, ... Read More

Using an External System that Syncs to QuickBooks

- Posted on Jan 9, 2025

If you are using an external system that syncs to QuickBooks, are you taking the extra step to review and compare the data to make sure everything synced over correctly? You should be if not. Just like bank statements, we download the data via online banking and then we reconcile to the statement to correct ... Read More

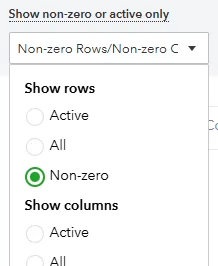

How-to Remove Zero’s on Reports

- Posted on Sep 24, 2024

If you ever go to pull reports, say a balance sheet or profit and loss report and you notice rows with zero’s. Did you know that there is a fix for that? There are two main reasons why this occurs: The first thing you need to do is try to fix the issues. If you ... Read More

Recovering Outlook Emails .ost to .pst Conversion

- Posted on Sep 24, 2024

Not my typical blog post about bookkeeping, but I recently had to deal with recovering Outlook emails and went down a rabbit hole on the internet trying to find a solution. We had a power outage, my computer was fried and wouldn’t turn on. Thankfully I was able to take out the hard drive and ... Read More

Load Balancing Your Dual WAN Router

- Posted on Feb 26, 2022

I purchased a dual WAN router last year to be able to hook my two separate internet connections into. The goal was to create a more reliable connection without switching internets constantly and to hopefully double my speed. Let me begin by saying, this is a short and sweet post about load balancing your connection. ... Read More

Expenses by Vendor Summary Report Issue

- Posted on May 27, 2020

One of our client’s wanted to review their vendor expenses to see where some money could be cut. I pulled an expenses by vendor summary report for 2019 and changed the columns by month that way they would see what was on a recurring basis. The accrual report displayed fine, but the cash report was ... Read More

Why You Should Hire an Experienced Bookkeeper

- Posted on Aug 24, 2019

Virtual Bookkeeping Services connects with many businesses seeking help and advice about their bookkeeping. A common issue between them is they have learned a valuable lesson and should have hired an experienced bookkeeper. The two most common reasons clients come to us for bookkeeping services after learning a valuable lesson are: the client does the ... Read More

When QBO Online Banking Fails to Connect

- Posted on Apr 22, 2019

A new client came aboard recently and needed assistance troubleshooting their American Express card that would not connect for months in their QuickBooks Online (QBO). They got no where with Intuit or Amex support and were frustrated over the time it was taking with no solution as this was holding up the bookkeeping. Try updating ... Read More

Blog Series 5 of 5: Common QuickBooks Terms – What is Retained Earnings and Opening Balance Equity

- Posted on Oct 26, 2018

What is Retained Earnings and Opening Balance Equity? In our blog series 5 of 5, common Quickbooks terms – What is Retained Earnings and Opening Balance Equity? These are special equity accounts created by QuickBooks and exist on the balance sheet. Retained Earnings – This account is used to track all profits for prior years ... Read More

Blog Series 4 of 5: Common QuickBooks Terms – What is Cash and Accrual

- Posted on Oct 25, 2018

What is Cash and Accrual? In our blog series 4 of 5, common Quickbooks terms – What is cash and accrual? Most business owners should know what these terms mean, but if you don’t work with them regularly, you may not remember the differences between them. Cash and accrual refers to how you report your ... Read More

Blog Series 3 of 5: Common QuickBooks Terms – What is Uncategorized and Ask My Accountant

- Posted on Oct 24, 2018

What is Uncategorized and Ask My Accountant? In our blog series 3 of 5, common Quickbooks terms – What is Uncategorized and Ask My Accountant? These are QuickBooks chart of accounts that appear depending on what version of QuickBooks you are using. They are used as temporary holding accounts to keep track of the transactions ... Read More

Blog Series 2 of 5: Common QuickBooks Terms – What is Unclassified and Not Specified on Reports

- Posted on Oct 23, 2018

What is Unclassified and Not Specified on Reports? In our blog series 2 of 5, common Quickbooks terms – What is Unclassified and Not Specified on Reports? These are both QuickBooks terms that are referring to transactions on the books that have not been assigned a class. A class is a department or location that ... Read More

Blog Series 1 of 5: Common QuickBooks Terms – What is Undeposited Funds

- Posted on Oct 22, 2018

What is Undeposited Funds? In our blog series 1 of 5, common Quickbooks terms – What is Undeposited Funds also known as Undeposited Income? These are both QuickBooks terms that simply refers to money not yet deposited. Both terms have been used in QuickBooks versions over the years. Let’s go through the process when receiving ... Read More

New Blog Series: Common QuickBooks Terms

- Posted on Oct 21, 2018

Introducing new Blog Series: Common QuickBooks Terms When using QuickBooks, there are terms used that their meaning may not be evident to everyone. This blog series called common QuickBooks terms will introduce the most common terms that our clients have asked us what they mean. Also covered are tips and processes related to each. Terms ... Read More

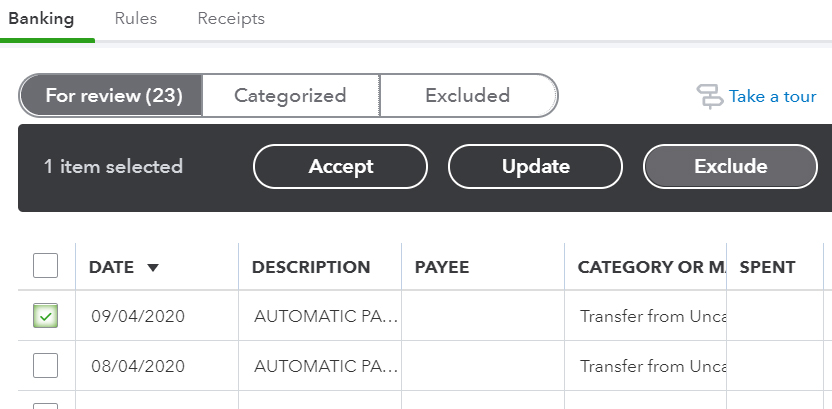

Exclude banking transactions in QBO – QuickBooks Online

- Posted on Oct 16, 2018

Have you ever needed to exclude banking transactions in QBO? It’s there for a reason and if you use the online banking function in QuickBooks Online, you need to know what it is for. I had a client once that didn’t get it, even after several explanations. Her not getting it was the result of ... Read More

Why Reconciling is Important

- Posted on May 31, 2018

We had a client that used accounting software that did not have a reconciling feature built into the software, you may have heard of it, QuickBooks Self-Employed. I guess their motto is that if you connect the program to your bank and download all the activity into the books, that is enough and no reconciling ... Read More

How much did I pay my vendors and receive from customers?

- Posted on Feb 27, 2018

There is a helpful report in QuickBooks that we get asked quite a bit how to do, how much did I pay my vendors and how much did I receive from customers? We had a client recently inquire over a report he needed on how much he has paid all his vendors for the year. ... Read More

Export Data from QuickBooks Online (QBO)

- Posted on Dec 7, 2017

Have you ever needed to Export Data from QuickBooks Online (QBO)? You may ask, why would I need to. We have seen clients go back to desktop version or simply just want a hard copy of the QBO data. To export data file from QBO, you would think it would be an easy process or ... Read More

Review of Fujitsu ScanSnap S1500 Instant PDF Sheet-Fed Scanner

- Posted on Oct 9, 2017

This is our review of the Review of Fujitsu ScanSnap S1500 Instant PDF Sheet-Fed Scanner. Bought it back in February of 2010. Fast forward, its now 2017 for this post and we are still going strong! No issues, has worked flawlessly, scans every sheet, no joke! Love it. I do a mass amount of scanning ... Read More